The truck was placed in service on January 10, the date it was ready and available to perform the function for which it was bought. Even if the requirements explained in the preceding discussions are met, you cannot depreciate the following property. Generally, containers for the products you sell are part of inventory and you cannot depreciate them. However, you can depreciate containers used to ship your products if they have a life longer than 1 year and meet the following requirements. In some cases, it is not clear whether property is held for sale (inventory) or for use in your business. If it is unclear, examine carefully all the facts in the operation of the particular business.

Table A-16: 150% Declining Balance Method; Mid-Quarter Convention; Property Placed in Service in Second Quarter

If you trade property, your unadjusted basis in the property received is the cash paid plus the adjusted basis of the property traded minus these adjustments. Depreciate trees and vines bearing fruits or nuts under GDS using the straight line method over a recovery period of 10 years. Under this convention, you treat all property placed in service or disposed of during a tax year as placed in service or disposed of at the midpoint of the year. This means that for a 12-month tax year, a one-half year of depreciation is allowed for the year the property is placed in service or disposed of. The ADS recovery period for any property leased under a lease agreement to a tax-exempt organization, governmental unit, or foreign person or entity (other than a partnership) cannot be less than 125% of the lease term. However, if this dual-use property does represent a significant portion of your leasing property, you must prove that this property is qualified rent-to-own property.

- You reduce the adjusted basis ($480) by the depreciation claimed in the third year ($192).

- For the second year, multiply the basis by the second percentage on the list, and so on for each additional year for which depreciation is allowed.

- If the partner disposes of their partnership interest, the partner’s basis for determining gain or loss is increased by any outstanding carryover of disallowed section 179 expenses allocated from the partnership.

- The use of property to produce income in a nonbusiness activity (investment use) is not a qualified business use.

Declining Balance Method of Depreciation

However, the company needs to use the salvage value in order to limit the total depreciation the company charges to the income statements. In other words, the depreciation in the declining balance method will stop when the net book value of the fixed asset equals the salvage value. As the declining balance depreciation uses the net book value in the calculation, the company doesn’t need to determine the depreciable cost like other depreciation methods.

Fixed Declining Balance Depreciation Calculator

The DB method provides a larger deduction, so you deduct the $200 figured under the 200% DB method. Appendix A contains the MACRS Percentage Table Guide, which is designed to help you locate the correct percentage table to use for depreciating your property. MACRS provides three depreciation methods under GDS and one depreciation method under ADS. This is a racing track facility permanently situated on land that hosts one or more racing events for automobiles, trucks, or motorcycles during the 36-month period after the first day of the month in which the facility is placed in service. The events must be open to the public for the price of admission. Qualified property acquired after September 27, 2017, does not include any of the following.

The applicable convention establishes the date property is treated as placed in service and disposed of. Depreciation is allowable only for that part of the tax year the property is treated as in service. The recovery period begins on the placed in service date determined by applying the convention. The remaining recovery period at the beginning of the next tax year is the full recovery period less the part for which depreciation was allowable in the first tax year. If this convention applies, the depreciation you can deduct for the first year that you depreciate the property depends on the month in which you place the property in service. Figure your depreciation deduction for the year you place the property in service by multiplying the depreciation for a full year by a fraction.

For example, you can account for the use of a truck to make deliveries at several locations that begin and end at the business premises and can include a stop at the business in between deliveries by a single record of miles driven. You can account for the use of a passenger automobile by a salesperson for a business trip away from home over a period 150 declining balance depreciation of time by a single record of miles traveled. Minimal personal use (such as a stop for lunch between two business stops) is not an interruption of business use. An adequate record contains enough information on each element of every business or investment use. The amount of detail required to support the use depends on the facts and circumstances.

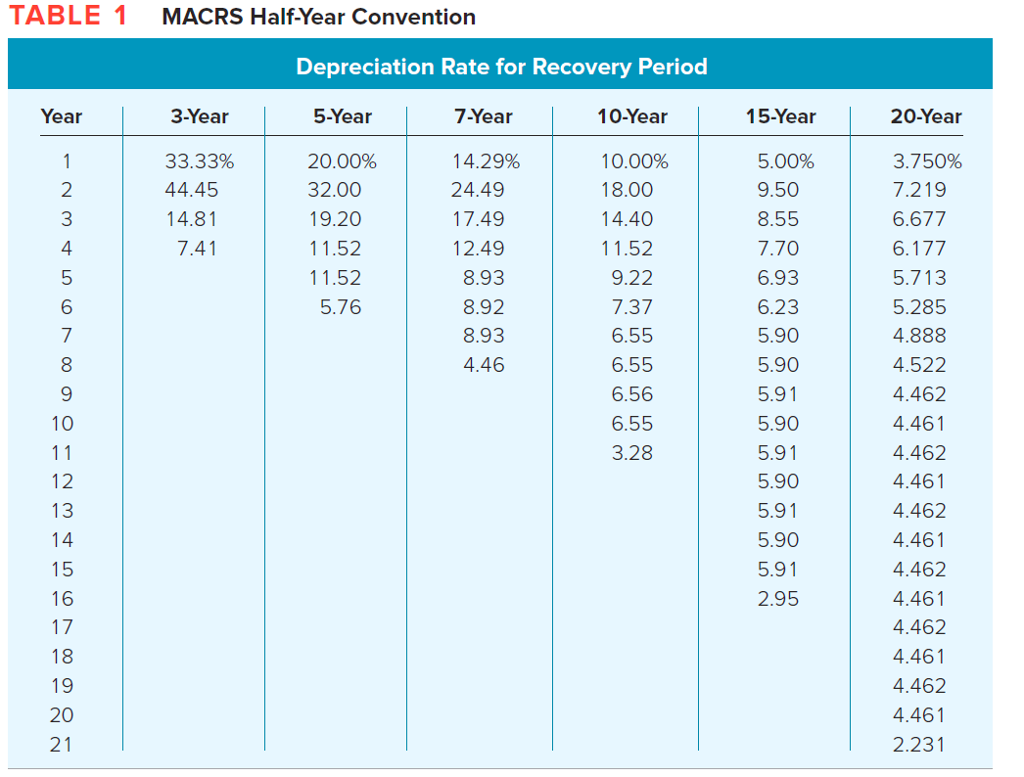

He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. Usually the calculation gives an answer to a number of decimal places, it is normal to round to the nearest whole percentage, as the salvage value can never be accurately determined. Your final steps are to complete Form 4562 – with the optional MACRS Worksheet starting on page 37 of Pub 946 to help you calculate your deductions. As promised, here are the MACRS depreciation tables referenced in the MACRS Depreciation Table Guide provided above. That’s the result of using the MACRS half-year convention, which only allows depreciation for half of the first and last year of depreciation.

If you were using the percentage tables, you can no longer use them. You must figure depreciation for the short tax year and each later tax year as explained next. To determine if you must use the mid-quarter convention, compare the basis of property you place in service in the last 3 months of your tax year to that of property you place in service during the full tax year. If you have a short tax year of 3 months or less, use the mid-quarter convention for all applicable property you place in service during that tax year.

If you are in the business of renting videocassettes, you can depreciate only those videocassettes bought for rental. If the videocassette has a useful life of 1 year or less, you can currently deduct the cost as a business expense. Instead of including these amounts in the adjusted basis of the property, you can deduct the costs in the tax year that they are paid. If you can depreciate the cost of a patent or copyright, use the straight line method over the useful life. The useful life of a patent or copyright is the lesser of the life granted to it by the government or the remaining life when you acquire it. However, if the patent or copyright becomes valueless before the end of its useful life, you can deduct in that year any of its remaining cost or other basis.